By Rohana Rezel

Bank of Canada governor Tiff Macklem said two weeks ago that he has yet to see any signs of speculation in Canada’s hot housing market1. We analyzed Metro Vancouver real estate data over the last decade to see if Macklem’s claim is based on facts. We found a clear increase in levels of speculation in the region’s housing market.

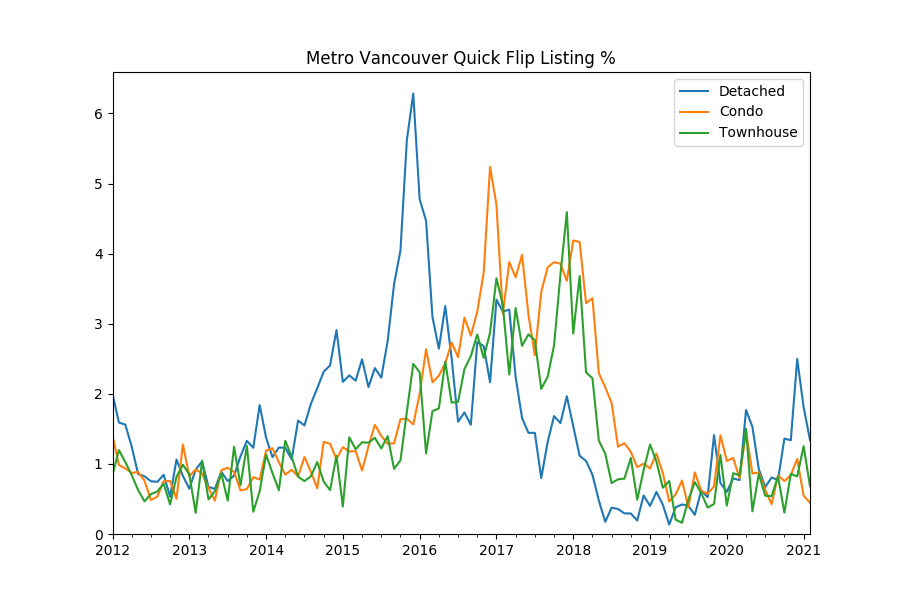

We looked at what percentage of monthly listings were quick flip listings, that is, a property being listed after being bought in the previous 12 months. Such quick flips are consistent with speculation, as the expected gains are almost entirely based on the appreciation of the asset as opposed to reselling with value addition through rebuilds or major renovations.

What we found is that during the pandemic, the percentage of such listings consistent with speculation for single detached homes rose sharply, reaching levels not seen since 2017.

In December 2020, 2.5% of detached listings were for quick flips. That’s the highest percentage of detached listings consistent with speculator activity since March 2017, when the figure was 3.2%. The level of speculation appears to have moderated somewhat since the sizzling December market, with 1.4% detached listings being quick flip listings in February 2021.

The highest ever percentage of detached quick flip listings was recorded in December 2015, when the number reached 6.28%. But between April 2018 and October 2019, the percentage of detached listings consistent with speculator activity stayed below 1%, reaching a low of 0.13% in April 2019.

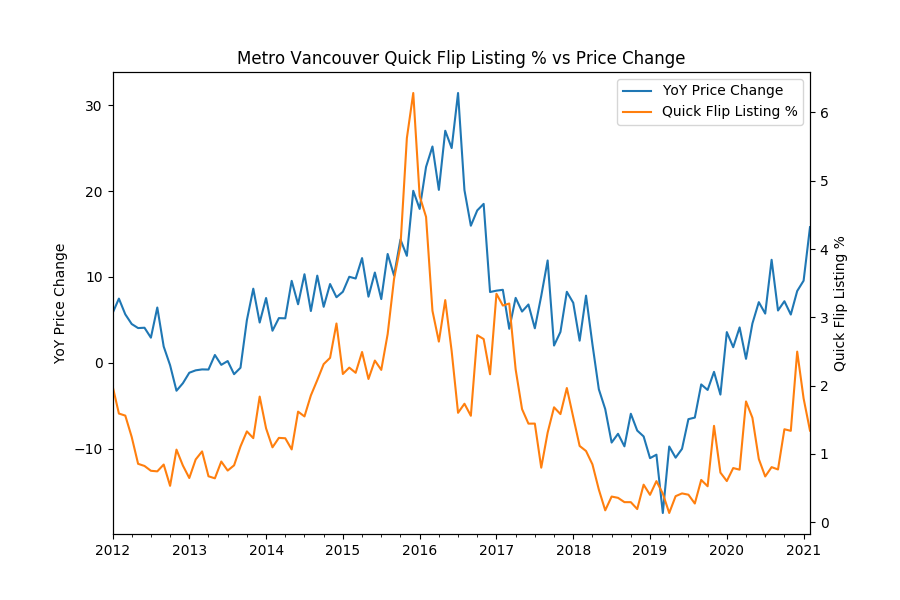

What we also found out is that there’s a strong correlation between the percentage of quick flip listings and price changes with a three month lag (correlation coefficient r=0.77 with a three month lag).

Simply put, whenever the level of speculation goes up, prices go up three months later. We understand that correlation does not equal causation, there does exist a plausible causality change to explain the link between increased speculator activity in the market and home prices: increased speculative buying increases demand, and increased demand increases prices.

We’re not sure why the Bank of Canada keeps insisting that it sees no speculative activity in the market when the data shows otherwise. But, as the runaway home prices worsen the housing affordability in urban centers like Metro Vancouver and Great Toronto, Tiff Macklem should take a close hard look at the data again.

Contact the Author

You can reach Rohana Rezel at [email protected]. You can also find him on Twitter, Facebook and Github.