A West Vancouver property is being advertised as offering both incredible views and an opportunity to avoid taxes using the bare trust loophole.

“Incredible opportunity to purchase an incredible view lot in situated on a private cul-de-sac in an amazing location,” reads the listing for The bare lot at 5644A Westport Road in Eagle Harbour. “Expansive views from Eagle Harbour to Vancouver Island will be enjoyed from all 3 levels of your new dream home.”

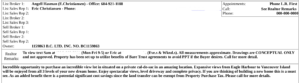

“As an added benefit there is a potential significant cost savings since the land transfer can be exempt from Property Purchase Tax,” the listing, by Angell Hasman (E.Christiansen) Realtor Eric Christiansen, adds. “Please call for more details.”

“Property has been set up to utilize benefits of Bare Trust agreements to avoid PPT if the Buyer desires. Call for more detail,” The once high flying luxury realtor Christiansen explains in the realtor remarks section of the listing, which is only visible to other realtors.

The owner of the property is listed as 1159863 B.C. LTD.

According to the BC Corporate Registry, the sole director of 1159863 B.C. LTD. is Herbert Y. H. Locke.

Herb Locke, an engineer and real estate investor, is listed as the director of Omineca Environmental Inc, which shares the same address as the bare trust.

Province’s NDP government last fall announced that it was outlawing the use of bare trusts for the specific purpose of skirting property transfer tax 1.

“Our government has been clear that the days of skirting tax laws and hiding property ownership behind numbered companies and trusts are over,” Carole James, Minister of Finance said. “Not only is tax evasion in real estate fundamentally unfair, but it’s driving up the cost of housing for people who live and work in our communities. These changes give authorities another tool to make sure people are paying the taxes they owe.”

Starting Sept. 17, 2018, the new property transfer tax return require people to report additional information when a transaction is structured through a corporation or trust.

This allows the government to identify people with a significant interest in the property, and ensure the correct amount of tax is paid, according to the Ministry of Finance.