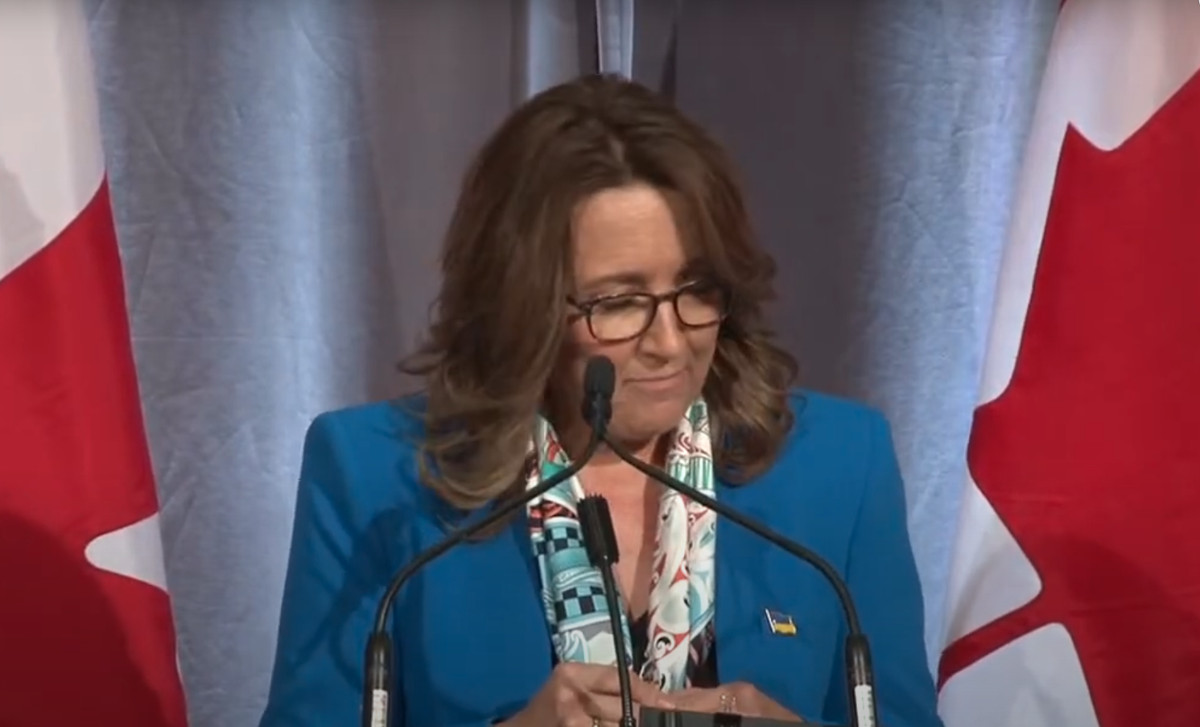

Bank of Canada’s senior deputy governor Carolyn Rogers’s real estate portfolio appreciated by $548,000 during the pandemic as low interest rates set by the central bank helped propel Canada’s home prices to record highs.

The deputy governor’s disclosure statement1 record she has joint ownership of two rental properties in Victoria, British Columbia.

BC Assessment records show that her investment property on Feltham Road appreciated by $271,000 while the property at Mayfair Drive appreciated by $277,000.

The deputy governor defended Bank of Canada’s credibility against strident public criticism even as the inflation rate hit 6.7% last month.

“The Bank took extraordinary steps to support Canadians during the COVID-19 pandemic,” Rogers said. “We dropped the policy rate to its effective lower bound, purchased government bonds and committed to keeping rates low until the economy recovered.”

“We took these steps to lower borrowing costs for Canadian households and businesses—not to help commercial banks or fund government spending,” she added.

“And when we took these unusual steps, we increased the transparency around our actions and boosted our efforts to explain them as clearly as we could for Canadians,” the deputy governor said. “Maintaining public trust is particularly important when uncertainty is high.”

The governor insisted that the Bank of Canada is doing all it can to lower inflation.

“Canadians trusted us to respond with strength and conviction when the economy needed support during the pandemic,” Rogers said. “And they’re counting on us now to lower inflation. We take that trust seriously. We’ve taken concrete steps to bring inflation back down to the 2% target. Interest rates will need to rise further, but we’ll be watching closely to see how the economy responds.”

We need your support

Please consider becoming an OpenHousing subscriber to support our transparency research.

Current inflation is for a large portion due to geopolitical situation; not finance. The government’s should work to resolve these tensions!

You’re joking right ??